Posted In: Law Firm Resilience, Profitability, Uncategorized

Your Partner FICO Score for Managing Performance

Law firm leaders constantly seek more effective and transparent measures to assess and boost their financial performance. Although traditional metrics such as effective rates, realization, profit margin, and leverage provide a foundation, their potential for misinterpretation and distortion often leads to more confusion than clarity.

In response, I created a new measure called the Partner Financial Performance Index to assess and improve partner performance and financial hygiene. It is designed to bridge the gap between traditional measures and modern law firm needs, producing a convenient, more transparent view of events.

The Partner Financial Performance Index

The index is a measure that combines standard performance metrics—examples including effective rates, utilization, timekeeping precision, inventory management, and client success scores—into a cohesive weighted average score, which can serve as a single performance reference.

A standardized scoring system (usually from 0 to 10) is applied where each incremental point on the scale signifies better relative performance. This scoring system lets partners quickly understand and track their performance, enabling instantaneous monitoring and trend analysis, like tracking a stock price.

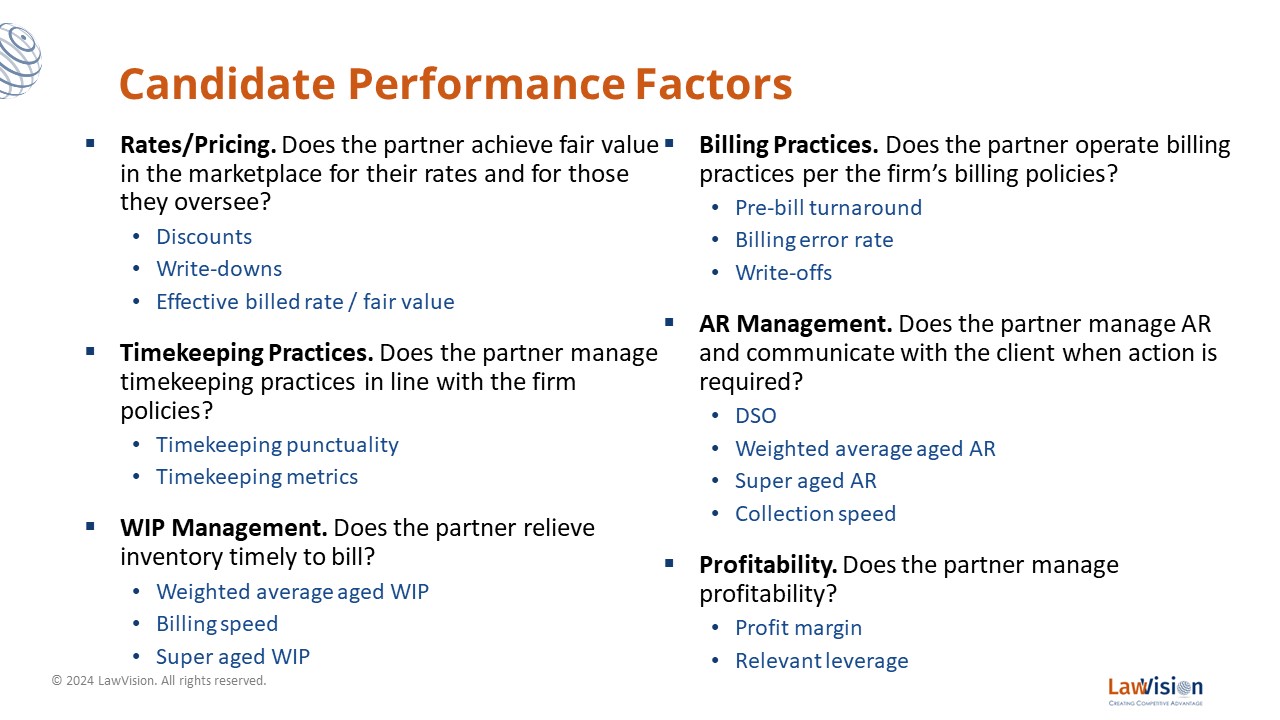

Below is a list of performance factors that could serve as inputs to your financial index:

Building the Index

Building the index starts with an evaluative framework—identifying the firm’s strengths and areas for improvement, along with the relevant data to feed into the index. Initial weightings might reflect the firm gaps or focus areas. It is calibrated based on the statistical significance of the underlying raw inputs relative to established benchmarks, firm standards, and strategic priorities. From there, the index undergoes a series of refinements through iterative backtesting or pilot studies, ensuring its accuracy and fairness.

Applications

The index calculation originates at the partner level but can roll up to practice areas, industry sectors, or the entire firm, enabling an evaluation of performance across various firm dimensions. It can also serve as input for client and matter scoring, helping to forecast the likelihood of financial and broader legal risks tied to client and matter success.

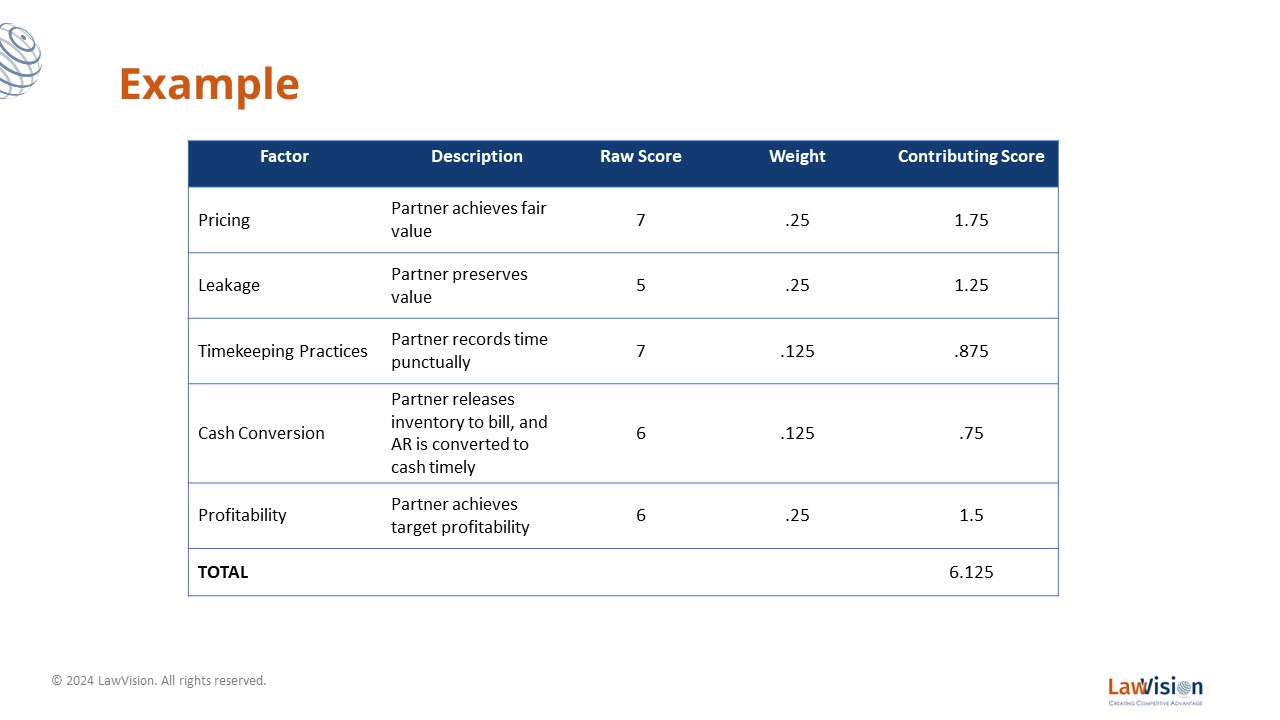

An example of an index calculation is illustrated below:

Getting Started with Your Financial Index

The time from concept and design to initial calculation typically takes several weeks. The process includes gathering and scrutinizing data inputs, selecting factors, calculating the weightings, producing the score, and examining the historical trend line.

In tandem with this process, it is crucial to plan an educational program directly linked to the index’s development. This program is designed to help lawyers understand its purpose and learn how to use it effectively. It is intended to guide performance and foster a culture of learning and evolution.

To learn more about the potential of the index in your firm, contact me at mmedice@lawvision.com to explore how this innovative tool can be deployed in your firm, paving the way for refined performance management and strategic success.