Pricing Analytics Survey Background

To help law firms think about pricing strategies in the wake of the pandemic, we recently conducted a pricing analytics flash survey, with our partner Clocktimizer, to explore pricing capabilities, priorities, and thinking about what comes next, in terms of change. We received responses from pricing chiefs, value officers, managing partners, CFOs, and other law firm pricing stakeholders. Below is the summary of those results (listen to the survey webcast presentation; participate in the pricing analytics survey).

Themes

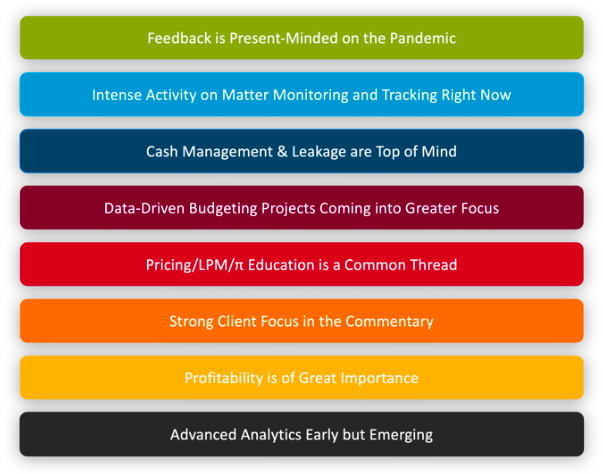

We observed many themes from the respondents. First, firms remain present-minded to navigating through the first phase of the pandemic cycle, focusing on health, safety, clients, and cash management. Lawyer pricing/LPM education is a common theme joined by the importance of matter management. Client centricity is front-and-center in the responses, and analytics continue to play a supporting but accelerating role.

Essentially, survey sentiment indicated that firms are managing through the pandemic while awaiting the pivot to “new” normalcy. And questions linger about how unique those pathways might be for each firm.

These themes are summarized below:

Capabilities

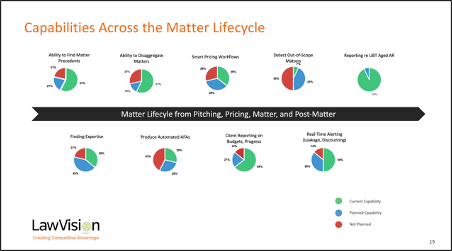

In terms of current pricing analytic capabilities, many firms reported competency in quickly locating matter precedent, disaggregating matters by phases, and providing real-time reporting and alerting. Additionally, many firms are planning and designing smarter pricing workflows, real-time alerting, and expertise location. Whereas, more advanced capabilities like producing automated AFAs and detecting out-of-scope matters were not on the horizon for most firms responding.

The chart below lists these capabilities, placing them throughout the matter lifecycle by phase below. When viewed collectively and in context with each other, moving functionality further upstream may proactively magnify their impact, reducing firefighting and issue-chasing.

Priorities

We asked about pricing priorities, exploring where these focus areas might sit within an organizational framework categorized by (i) people, (ii) process, and (iii) technology & new metrics. Listed below are those priorities by the percentage of respondents, followed by an illustration with firms’ responses by category:

- Smarter Pricing Practices (72%). 72% of respondents indicated that they were introducing smarter pricing practices, which includes value pricing, AFAs to offset discounts, creative fee structures.

- Accelerated Education on Pricing and Profitability (67%). Somewhat a corollary to Smarter Pricing Practices, 67% of the respondents indicated their intention to accelerate education and training on pricing and profitability principles.

- Managing Matter Leakage (61%). 61% indicated plans to concentrate efforts on managing matter leakage.

- Embracing Legal Project Management (LPM) (44%). 44% indicated their plans to introduce more discipline in matter management and legal project management.

- New Pricing Metrics (44%). 44% suggested their plans to consider and implement new pricing metrics.

- Addressing Unnecessary Discounting (39%). 39% indicated their plans to shore up unnecessary discounting in matter pricing.

- Tools to Study Production Costs (39%). 39% indicated an intention to utilize tools to study production costs as a basis for introducing creative fee structures and be more precise in the budgeting process.

Anticipated Changes Ahead

The survey asked respondents to rate expected changes to pricing practices. The top answers included improvement to leverage and other profit practices, more rigorous controls over pricing practices and matter management, the use of creative fee structures to mitigate client discount requests, and accelerated use of financial matter monitoring. Respondents mentioned client proactivity as perhaps one of the most critical things for firms to institute to maintain a competitive edge going forward.

Data Science & Pricing

Lastly, we took note of how accelerated uses of data might aid firms in enhancing their capabilities and priorities described above. We reviewed the potential of data to optimize rate performance, signal indiscriminate rate discounting, mitigate cash leakage, create early warning systems. On a grander scale, webcast discussion included opportunities around matter genome modeling, auto-task classification, and machine-generated AFAs based on matter characteristics and profiles.

Conclusion

We sit in the eye of the pandemic. And already there are key learnings, behavior changes, and innovative pricing strategies emerging. As we turn our focus from the initial pandemic shock to restart, there are important considerations firms should think about related to pricing, profitability and the underlying data model. Capabilities like quickly creating precise AFAs while generating good returns for law firms may become the norm for best practice law firms. For more details about the survey and its findings, contact Mark Medice at mmedice@lawvision.com.