While we are in the early days, 2022 has already delivered many gifts to us, including stock market volatility, high inflation, the advent of military conflict, and continued law firm associate salary “wars.” Yet law firm economic performance rages on unabated — or does it?

Current Law Firm Economic Picture

The Peer Monitor Q4 2021 Index dropped to 58 – compared to 67 in Q3, and far below its Q2 2021 high of 84. Not to worry. The report theorized that the index score returned to more “normal” comparisons as the economy recovered. In contrast, the higher prior quarter index readings were postulated as artificial, inflated benchmarks created through pandemic demand volatility.

The report highlighted familiar themes about the strengths of transactional practices countered by rising compensation and overhead expenses, including technology, office, and business development expenses (returning to new normalcy, perhaps). Both direct and overhead expenses increased 3.8% and 5.8%, respectively, with growth in average associate compensation reporting a staggering 11.4%.[1]

Revisit Your Profit Plan

So how should you think about the above economics against your 2022 profitability goals? Forecasting is difficult because of increased economic volatility and the shellshock of waiting for the next shoe to drop. And you must plan for the post-pandemic new normal as well.

Identify Your Priorities and Avoid Distractions

One of the challenges in profit management is focus, so uncertainty only makes this more difficult because of distractions. But focus becomes even more critical under these circumstances. When you consider issues like associate compensation, recruiting/retention, diversity/inclusion, and returning to the office, they all intersect with profit management.

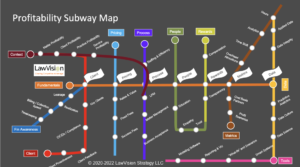

Too often, however, profit is confused as a single metric. But profit metrics are derived from underlying operational elements, as illustrated in the LawVision profit subway map below. The map shows profit relationships and how modifying one part may affect another.

So, while many firms will spend considerable time on the People/Rewards track this year, one might also consider its relationship to other performance factors. For example, paying associates higher salaries directly affects utilization, rates/pricing, discounts/write-downs, leverage, reporting, and overall transparency. Observing these interrelationships and then sorting them into your preferred strategic order is the essence of executing a profit management operational framework.

2022 Profit Management Planning Checklist

Here are some things to check to help you identify profit management priorities in 2022 using the chart above as a reference:

- Profit Acumen. Is your firm’s profit acumen increasing? Do your leaders and team members have a lexicon they use to discuss the impact of decisions like rates, discounts, and their effect on profitability? Your “profit language” creates efficiency in management and communication while reducing errors and misunderstandings. It also reinforces accountability.

- Everyday Application of Metrics. Does your firm utilize profit measures that inform performance standards and create visibility? And are those measures employed throughout your matters and during post-matter reviews? Does your firm act to remediate performance deficiencies like time-tracking, budgeting, write-downs, or discounts timely?

- Associate Compensation. Are you factoring profit metrics into your decisions on recruiting and retention? Can you afford to pay all associates uniformly across practices? The answer may be yes but must be reflected clearly in your performance plans.

- Talent Engagement. One of the necessities for 2022 is talent engagement. How do we bring people together to create bonds that are impossible to develop in virtual environments while accommodating the benefits of remote working configurations? Getting people back to the office requires creativity and thinking to draw out the benefits of in-person experiences. Sharing performance opportunities for the firm may play a role in this process, especially if used to align teams and stimulate change (see below).

- Inflection Points. Have you identified points in the law firm client/matter lifecycle that impact high performance? Fixing or tuning these areas will magnify your results. For example, do you perform profit assessments during matter intake, when setting matter rates/discounts/staffing, or when you take on a new client? Think about ways to move your efforts upstream before significant problems develop and create new institutional profit muscle memory at those points.

- Metrics to Motivate and Stimulate Change. Should you use profit metrics as a tool to highlight new opportunities, introduce new ways of doing things, and drive productive change? Too often, profit is applied as a penalty box rather than a guidance and opportunity system.

Summary

2022 will undoubtedly bring new challenges and opportunities for law firms and their economics. As we reflect on the recent pandemic years, take pride in the industry’s collective achievements, and acknowledge its talent struggles, this year is destined to be an inflection point for the new normal. Naturally, profitability will play a vital role here.

There are no guarantees that unexpected events may yet throw our best-laid plans off track, but effective use of performance metrics and accountability can serve as shock absorbers – not to just weather the storm but to sail through it.

[1] For now, we will ignore historical statistical relationships with associate salary wars and their correlation to legal industry recessions.