Whenever the growth in demand for legal services slows (and it cannot get much slower than right now), we hear from many law firm management teams that they are highly focused on expense control… as if this is not an ongoing obligation and these firms willingly leave money on the table during good times.

I acknowledge that there are degrees of cuts and most firms are now “into the bone” with respect to the depth of their efforts. I also know, as everyone does, the old saying that you cannot cut expenses and create prosperity. In this article, however, I want to go in a counter-intuitive direction and explore another old saying that has rarely been applied to the legal industry in the past few years – you need to spend money to make money.

The contrast between these sayings highlights the difference between “expense control” and “efficiency creation”. Expense control is the act of finding the lowest price point available for needed, commoditized services and products – a buyer’s action. Efficiency creation is the act of developing new processes to materially improve the productivity and/or profitability of commoditized services and products – a seller’s action.

Prior to the recession, efficiency creation was a foreign topic to most law firms because such actions would have decreased revenues – a heretical concept at the time. Some firms actually actively opposed efficiency improvements because of their anticipated impact on billable hours. The world has changed, though, and now this action is viewed positively by some (but not enough) law firm leaders because, if implemented properly, it increases profits or, at a minimum, helps you hold on to the clients, and the associated revenues.

Efficiency creation requires investments of time and money that should generate multiples of return on the initial outlays, if directed wisely. As a basic business proposition, that looks quite appealing. So why isn’t there an industry-wide stampede toward revolutionary processes for handling commoditized services? For the answer, you have a choice between two more old sayings here – you cannot teach an old dog new tricks OR you can lead a horse to water but you cannot make it drink. Both are apropos because both represent the current state of many law partnerships – old, stubborn and change averse.

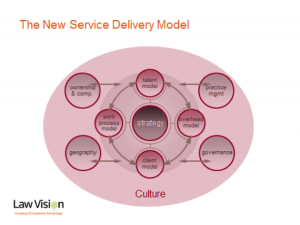

In our recent newsletter, we wrote about the characteristics of winners and losers in today’s legal marketplace. Many winners are spending money – wisely – to make money. While there is no single roadmap to making these investments, they do align nicely with our view of the law firm service delivery model.

Client model investments can include analysts who monitor key segments of the firm’s client base, client interviewers, and pricing specialists who can translate a client’s pain-points into a mutually beneficial workplan and fee structure. They can also include building and training client teams and rethinking your overall approach to client relationships.

Work process investments can include analysts who are adept at breaking down routine processes into specific steps and tasks, training in practice management, project management and process improvement, and software programs that help track progress against budget on matters or provide real time information at the practice group level.

Talent model investments can include a Director of Professional Development, an analysis of the characteristics of successful hires, a review of viable alternative staffing options, and performance tracking software. They can also include investments in restructuring the overall talent pool, and training of lawyers and others to think differently about their own role in the delivery of client services.

Overhead model investments can include consultants who specialize in the strategic design and deployment of office space and the software tools that they use. This category of costs is not as “fixed” as it used to be. They can also include increasingly sophisticated technology designed to streamline back and front office processes, outsourcing of key non-strategic functions.

Any of these investments, when made individually, can have a modest positive impact on a law firm’s bottom line. A combination of these investments, when made in concert, can have a major impact on any law firm’s bottom line…provided that the old dogs are receptive to some new tricks.