Financial Performance Diagnostic

Metrics and accountability are essential parts of your law firm’s performance. But not all are created equal, nor do all have the same impact on your firm’s bottom line and your specific profit destination. Some are out of date with today’s pandemic-led legal environment, while others remain dormant, underutilized in firm operations.

To help firms think about these ideas, I recently developed a law firm financial hygiene diagnostic, with the assistance of our partner, Neota Logic (for more information, or to utilize this diagnostic, press this link). The diagnostic is designed to assess firm performance on specific measures, while also offering composite views on key performance metric categories.

The purpose is to advance thinking on good financial hygiene that leads to profitability. It offers firm-specific scoring against industry benchmarks. And it encourages folding these measures into the daily routine through reporting and smart alerts, discussed in more detail below.

Key Measures

The following measures are likely familiar to you. Like single musical notes on the scale, the challenge for most firms is not producing individual measures, but utilizing them as a collective, harmonizing these measures in a way that drives profitable client success. It isn’t enough to have metrics. You also must have actionable workflows and individual accountability. Workflows enable and guide relevant action, while accountability puts people on notice of their importance and personal consequence.

I have broken these measures into four major categories: (1) revenue producing metrics (e.g., pricing, value preservation and productivity), (2) financial hygiene metrics, (3) overhead and overall expense structure, and (4) reporting and signaling.

Pricing and Value Preservation

Pricing effectiveness and value preservation is a multi-faceted category. It reviews your firm’s performance and discipline on initial client/matter pricing, fee structures, discounting practices, leakage/write-downs, post-bill discounts, and leverage performance. It reviews individual metric performance to assess your overall pricing effectiveness.

This performance category examines your firm’s realization of service value (i.e., are you pricing to achieve fair value for your work and holding value to fee collection). Your practices must utilize a pricing lexicon that informs market value and guides pricing processes to that point. They must also factor appropriate staffing models and process controls to deliver efficient client value within budget.

Questions to ask include:

- What is value? Value isn’t your billing rate. Instead, it is a much more nuanced inquiry that explores client benefits, your capabilities, and market alternatives available to achieve them. This idea can be challenging for partners to incorporate into the daily routine.

- What are the reasons for “unnecessary” discounts, and do you even categorize them that way?

- Do your highest rate partners benchmark favorably against your peers?

- What is your matter leakage pattern – is it random, or are there patterns exhibited by specific clients, billing/relationship partners or service types?

- Is time routinely written down because of miscommunication that could be corrected with better team dynamics and matter management protocol?

- Do you have metrics that inform those ideas and encourage discussion around how to improve service delivery, increase team communication, and streamline matter management?

Productivity

The notion of productivity is important, but a dangerous term for law firms since it is often associated with its legacy definition: the number of billable hours produced per lawyer (which frequently makes clients cringe). There is vast industry discussion about different ways to think about this metric (beyond the scope of this blog). One idea might be to think about the effectiveness and efficiency at which you deliver beneficial value to your client. No matter how you define this measure, a bona fide client-centric version will support your profitability.

Financial Hygiene

Financial hygiene is a critical component of firm performance. Firms work hard to create inventory with the potential to convert to collectible fees if well managed. Large law firms, in aggregate, lose more than $10b in value leakage (write-downs and write-offs) after taking another $10b in discounts. This value loss occurs for many reasons, including poor timekeeping routines, inefficient work practices, poor matter management, bottlenecked billing, among other reasons. To improve, you must systematically measure and manage this process.

Time kills cash. If you compress cash conversion (i.e., billing and collection speed), you will convert more of it more quickly. Doing this also forces you to face uncollectible WIP and collection issues sooner, which will improve your financial forecasting. Of course, every firm tracks WIP and AR, but with varying degrees of management control and effectiveness. Do you report and hold lawyers accountable for managing this process individually and for the teams they lead? Do you measure and enforce daily timekeeping routines, invoice processing against time and quality standards? Is it common for partners to engage clients in discussions around billing requirements and their needs? Partner engagement accompanied by a rigorous process are often missing pieces to this category.

Overhead

One of the biggest myths in assessing overhead is believing bottoming or topping out a category is equivalent to operating with the greatest efficiency (e.g., lowest staffing ratios, highest secretarial ratios, lowest overhead expenses as a percent of revenue, as examples). Instead, consider your firm’s infrastructure costs relative to your firm’s growth prospects, desired profitability, and overall strategy. Ratios and efficiency are certainly important and must be measured. But not all firms are similarly situated in terms of services offered, the number of offices, markets served, investment profile, among other factors. A growing firm in investment mode is likely to have higher proportional expenses than others, all things equal. Thus, review your efficiency ratios in the context of your position and direction.

Alerting and Reporting

Financial reporting is a key element to high performance, but there is vast untapped potential in this category given today’s technologies and available data. And there is a wide range of reporting methods, some of which make a bigger impact on your bottom line. Your dusty report on the shelf that no one reads is quite different than a financial alert that calls for specific improvement against a timetable, assigned to a person or team.

Do you produce alerts on discounting practices or notable events like leakage, WIP spikes, matter scope changes? Do you grade matters for financial risk at client or matter intake, and monitor diligently through the engagement? Do you trigger alerts on accumulating inventory? Do you produce periodic reports for partners and join results with compensation? This kind of active reporting and accountability is key to moving the needle on performance. Moreover, deploying feedback loops will support continuous performance adjustments and provide practical lawyer education.

Your Firm Index – Tying This Together

Most firms track and report extensively in the categories described above. The challenge is putting it all together into a broader framework or composite to systematically guide, motivate, and modify behavior. This idea differentiates higher-performing firms from others.

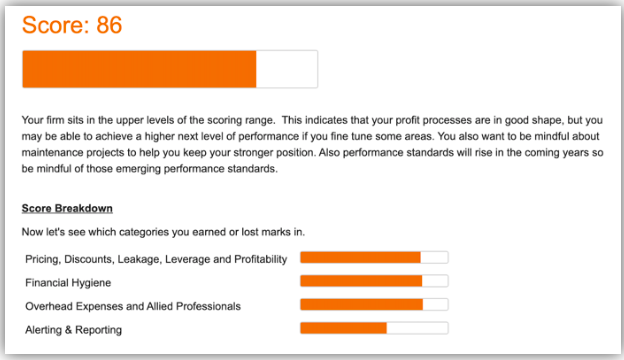

Imagine that you produce a scorecard or index for the firm, practice or each partner that continuously informs financial performance against these categories, while connecting this index to client satisfaction and other key metrics (e.g., diversity, client satisfaction, talent retention). Below is a high-level example of a quick diagnostic that we are introducing to produce such a report.

Your Next Steps

Performance matters, and it becomes especially apparent during economic downturns. But firms should operate systematic financial processes during every economic season. It will support your client service aspirations. For more information on our financial diagnostic or strategic financial performance, contact Mark Medice at mmedice@lawvison.com.