Economic Preamble – Setting the Scene

In January, I conducted a law firm sentiment survey inquiring how firms performed in 2019 and whether 2020 would bring more or less favorable results. The respondents indicated a very bullish 2020 forecast, with over 80% of firms reporting excellent 2019 results with an anticipated stronger 2020. Not surprisingly, an identical survey conducted in March muted those projections, with nearly the same percentage expecting a down 2020.

The COVID-19 pandemic has changed things dramatically and quickly. And unlike past economic cycles, this event arrived with little warning.

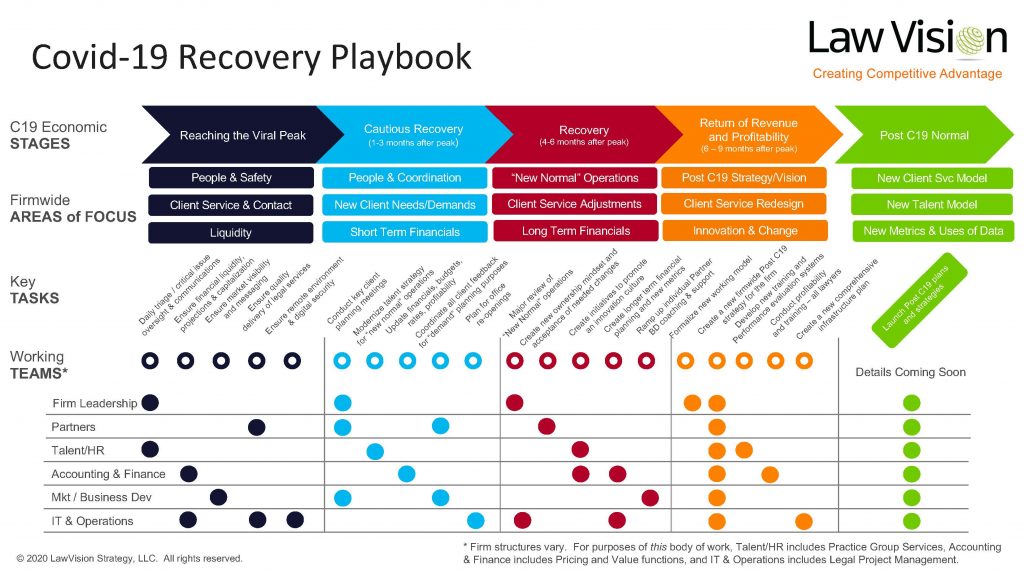

To aid firms in navigating through the most recent crisis, at LawVision we created a playbook[1] to help firms through the current crisis, which is summarized in the visual below. It offers guidance on prudent steps to take for economic recovery while positioning the firm for the post-COVID-19 legal operating environment.

The playbook details are not the subject of this article. But if you peruse many of the recommended tasks above, you will see that, quite naturally, that in times of economic stress, managing finances proactively is an existential priority. We have to survive the short term to play in the long run.

But it is also true that with today’s data capabilities, deploying financial monitoring systems that review liquidity, profitability, cash leakage, good-paying clients, and ultimately help to optimize profitability is no longer a luxury, but a necessity.

If the pandemic teaches nothing else, the need for faster, better-informed decision-making will be characteristic of successful firms in the recovery. And deploying these data-driven capabilities will be a crucial ingredient for success in the next wave.

The Next Data Wave is Coming

Shortly after the last recession in 2011, Marc Andreesen published in the Wall Street Journal, “Why Software is Eating the World”. In the article, he described how data and digital workstreams are increasingly becoming the heart and soul of many companies.[2] His point was that data would impact the fundamental business model for many industries, describing it metaphorically as “oil for the 21st century.”[3]

While most law firms did not transform their business model through the use of data over the past ten years, many began a meaningful journey to producing profit metrics, conducting real-time reporting, and building performance workstreams. What changes should we expect for the next decade, in light of the pandemic?

Law Firm Financial Performance Changes Resulting from the Pandemic

The priorities for data follow business needs. Thus, the logical starting point for the next wave begins by reviewing firm financial trends that may come about due to the effects of the crisis, such as:

- Redefinition of law firm financial performance. Economic cycles invite reflection about the definition of performance. Through the years, firms have evolved their thinking on topics like profitability and partner performance, gradually, but not entirely, moving away from pure revenue-oriented models to those based on net contribution. Concepts like productivity have advanced as well, although the legacy of the billable hour metric remains for most firms.

- Expanded new roles related to managing firm performance. Over the past decade, we saw pricing and legal project management roles emerge, and more recently, innovation and value officers. Many law firms are also embracing legal operations concepts and structures, somewhat parallel to their clients. These roles will further develop. Along with these developments, expect to see data officers and data scientists emerge, especially as it relates to helping firms deliver improved profitability. The role of a profit leader (quite different from CFO) may emerge to lead pricing initiatives, manage profit analytic projects, monitor profitability, educate and train the lawyers, and help to define performance metrics.

- Evolution of new performance metrics creating new incentives. New metrics are a topic that frequently surfaces during crises. Are we using the right metrics to inspire efficient work? Shall we yet again consider moving away from the billable hour as the primary production metric that frequently motivates the wrong kind of behavior? The creation of more authentic measures of productivity and effectiveness is warranted. Imagine a composite metric that blends client satisfaction, matter profit margin, and lawyer contribution, as a more relevant performance measure for the coming decade.

These trends and others will increase the need for an enhanced data financial framework. They will build on the model described below.

The DATA -> INSIGHT -> ACTION workflow illustrated below plots the three steps most firms use to manipulate data to support general operations: (i) data aggregation, (ii) insight generation, and (iii) resulting actions taken. In the next wave, data quantities will be exponentially larger, decision models will become more sophisticated, and the importance of follow-on action will be paramount. Firms that are more adept at scaling this analytical workflow will reap the most pronounced market rewards. To scale, you will need multi-faceted expertise in the relevant problem domains, more robust analytical capabilities, and perhaps most importantly, the ability to illuminate issues and opportunities to enable active decision-making and follow-through.

Imagine, for example, automating a smart budget process that generates a matter budget by designated profile, optimized for profitability, and calibrated to maximize client satisfaction. The profile would also recommend staffing models while factoring in resource availability and expertise. This overall process would happen in seconds, rather than hours or days, and the results would be much more precise and targeted.

Law Firm Performance Data Operating System

Every firm today has an existing set of interoperating profit workflows and metrics. As firms become more digitized, you can envision how these pieces become more dynamic, integrated, and operate in real-time. You might think of this as a performance data operating system. It should tie data to strategy and service principles. It will manage legal service delivery, matter management, profitability, talent & diversity, among other critical workstreams, serving as your firm’s nervous system. Additional characteristics include:

- Greater Agility. Data-driven operating model deployments have been underway for years, but economic events will accelerate their criticality. Thus, be prepared to move quickly on your model and data integration, and to pivot to exploit opportunities and reduce risks,

- More Forward-looking Views. Upstream applications will seek to eliminate or mitigate issues before they happen, and your design should focus on insights and actions that solve problems before they happen,

- Tighter Coupling to Action. Increasingly, metrics and smart workflows will produce action sets that yield entire guidance systems. These smart-systems will enable rapid responses to critical issues.

- Broader Firm Operations Scope. Data streams will address both the business and practice of law, potentially transforming the law firm business model.

Performance Data Operating System – Key Applications

Key uses will evolve out of current firm activities, while new ones may emerge, examples including:

- data insights supporting upstream profitability, pricing, cash leakage management, matter risk mitigation, and cash conversion,

- smart pricing and more rapid AFA deployment based on knowing your underlying costs with precision,

- automated matter budgeting and profiling systems,

- client and matter portfolio risk profiling,

- data that provide insights and guidance on matter profiling, budgeting, matter management, staffing, experience, after-action reviews, and knowledge management,

- predictions on matter outcomes, matter profitability, client attrition, client needs, talent success rates, etc.,

- client listening and need triage systems,

- software-guided client compliance and OCG systems,

- digital client firm “situation” rooms (think smart Zoom rooms blended with Slack, and relevant client metrics),

- use of industry matter standards and new client metrics,

- outcome scenarios for budgeting and setting client expectations.

Data Design Must Drive Action: Living Analytics

Data value correlates directly with utilization. A report sitting on the shelf or only known to one analyst is worth substantially less than data guiding the firm on client management, pricing, profitability, matter management, or case assessment.

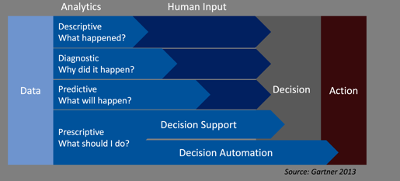

Today, most data experts classify data insights into four groupings: descriptive, diagnostic, predictive, and prescriptive, as illustrated in the chart below published by Gartner.

Applying the above framework to profit metrics, you can think about how metric design, their intended purposes, and anticipated uses may change as you push further into decision automation. For most law firms, decision automation remains an aspirational goal. Right now, the greater focus rests on diagnostic metrics and predictive analytics. In the table below, I list profit metrics and how you might think of them by the phases in the continuum.

Living Profit Analytics for Law Firms

Financial Data Strategy and Your Prioritization Framework

All data projects struggle with basic economic constraints: many opportunities competing for limited resources. This premise was true pre-recession and will be more constrained immediately afterward.

Below are considerations for law firms that I adapted from a recent HBR article entitled “When Data Creates Competitive Advantage.”[4] These questions serve as a prioritization framework to inform your priorities and overall strategy:

- How valuable is the data to your firm and clients? How do you measure its impact and the return of value?

- What is the action rate of your data? Do you act on the insights provided? To what extent and with what result?

- What is the depreciation rate of your data? Does it provide client or firm insight that rapidly becomes stale? Can your data be aggregated, creating network effects and competitive barriers?

- How unique is the value of data to your clients? The more unique to your firm in legal service delivery, the more potent and differentiated,

- Can data insights from one application flow into other applications to provide accumulating value? For example, can you design a client pricing system that integrates with your client triage intelligence stream and bundle those data sets together for unique value?

- How easy is it for competitors to imitate your data strategy and its execution? Are there any competitive moats or advantages gotten by this process?

- When does it make sense to be a market follower versus a first mover? Client service applications that generate business and profitability are applications worth pursuing as first-mover strategic projects, whereas traditional reporting systems might be followers.

Thinking about how the questions above may inform your project plans and your overall strategy. Even as budgets likely remain tight throughout 2020, it is imperative to plan and begin your steps for your accelerated data strategy.

Conclusion

Law firms are presently experiencing their third economic crisis in two decades. Each of these cycles has provided lessons about competitive strategy. And no doubt, the current economic cycle presents lessons of its own. As I have described above, this structure for data can provide context, help set priorities, and be a guidepost for planning and successful post-recovery execution.