Profitability Survey Background

To help law firms think about profitability strategies and best practices, we recently finalized our second annual profitability survey with Iridium Technologies. We received 101 responses from managing partners, COOs, CFOs, pricing chiefs, and other law firm stakeholders. Below I describe the summary of those results (to participate in the survey and receive detailed results, see this link).

Industry Context

Last year, when we issued our first profit survey report in early 2019, we highlighted the high proportion of satisfied respondents. We observed slightly increasing law firm demand (up from flat) and much stronger rate performance than preceding years, especially those years closest to the 2008 recession.

In January, when we launched this year’s profit survey, industry sentiment was very optimistic. Now in June, things have changed starkly. Many parts of our economy remain partially closed or paused, with economic activity gradually reemerging. Against this backdrop, law firms remain resilient but cautious. Since we received responses throughout this volatile period, our results must be interpreted with this dynamism in mind.

Key Findings

- Downshift in Profit Satisfaction. Approximately 68% of the firms said they were Satisfied or Very Satisfied with their profitability over the past three years. However, in 2020 about 30% shifted from Very Satisfied to Satisfied. Of note, this drop occurred before the current pandemic, which changed sentiment further.

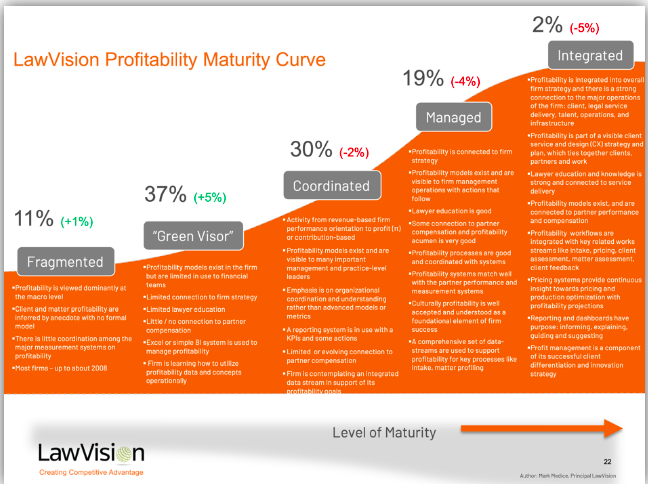

- Downshift in Profit Maturity. Profit maturity is an important concept, aiding a firm in its diagnosis while providing a roadmap for next steps. Interestingly, the 2020 responses shifted slightly down compared to 2019. Our first two profit maturity stages (Fragmented and “Green Visor”) observed a 6% increase in respondents, compared to a decline of 11% for the later stages (Coordinated, Managed, and Integrated). Of note, 11% of the firms self-assessed as Fragmented, operating with the simplest of profit processes and measures.

- The top barriers to profit progress were partner resistance and organizational inertia, our usual suspects. Perhaps the broad industry changes spurred on by the pandemic may aid in breaking through some of these traditional roadblocks.

- Regarding compensation and profitability, less than a quarter of the respondents are tightly integrating their profitability metrics into their rewards process, which was on par with 2019 results. Connecting profitability to rewards is crucial but typically occurs in later profit maturity stages.

- Like last year, we dug into the nuts-and-bolts of profitability, including reviewing profit metric calculations, expense allocations, profit distribution policies, special handling of business development/rainmaker expenses, data analytics, and other topics. Responses from this section reinforced the many important policy considerations that firms must make to maximize the potential of profit strategies.

Key Profit Projects

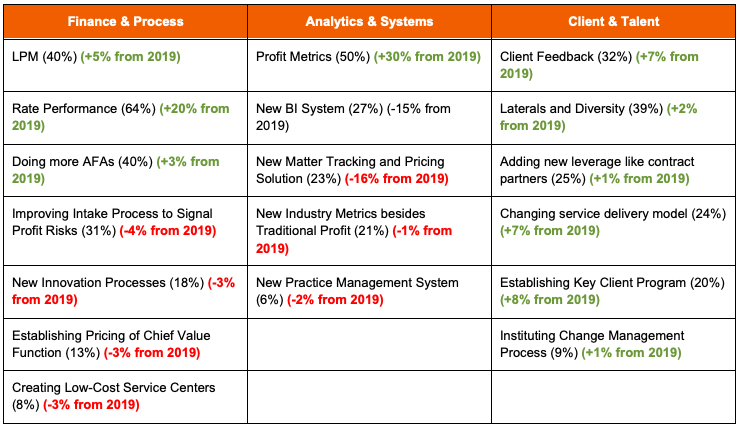

There are many doorways to profit improvement, so we asked about specific projects that firms are working. The table below lists those projects in three major categories (e.g., process, systems, and client), and highlights in green or red changes from 2019.

It was refreshing to see many projects focused on client initiatives, a critically important area to drive profitability. Pricing projects also showed an increase from 2019, along with the development of new profit metrics.

Conclusion

As we enter the summer season in the northern hemisphere, the timetable for economic recovery remains hazy. But we are observing “green shoots” of recovery now. And like previous cycles, these times are real opportunities for change. As we look forward, profitability is likely to be more critical for law firms. For more details about the survey and its findings, contact me at mmedice@lawvision.com.