Realization, the long-standing hallmark of law firm performance, is ready for a makeover. While the metric is not inherently flawed, its calculation and application have been twisted, resulting in misinterpretation and erroneous conclusions. Now that we have entered into the era of law firm profitability, the time has come to fix realization’s flaws and put it to better use to help you elevate your financial performance.

What is Realization?

In its purest form, realization measures value achievement.[1] You set a standard value (e.g., rack rate) and observe whether you have exceeded or fell short of that criterion. The problems begin with setting standards and end in tabulating and misinterpreting the results.

Realization and the Matter Lifecycle

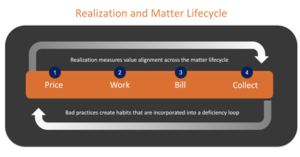

The visual below illustrates the many points across the matter lifecycle where you should measure lost value:

● The discount period between points 1 and 2 (10%+ lost value by industry standards)

● The write-down period between points 2 and 3 (12%+ lost value)

● The write-off period between points 3 and 4 (3-5% lost value)

The interesting thing about these periods and realization is that, in some cases, they exhibit problems based on bad organizational habits across the lifecycle. In other cases, issues persist unique to a period.

For example, poor discounting practices don’t automatically translate into higher matter write-downs; on the other hand, the mindset connected with random discounting may well carry over into a partner’s willingness to write-down value during the engagement on the bill.[2]

Now that we have a framework for realization diagnostics, let’s dig into common problem areas with recommendations on what you might do to course correct.

Problem 1: Realization is narrowly calculated but broadly applied.

Perhaps the biggest problem with realization is that firms often use billed-to-work value as a lifecycle statistic, meaning it calculates the value loss between stages 2 and 3 while being interpreted through steps 1 through 4. The obvious problem with this approach is that it ignores discounting and collections and provides an inflated view of performance.

Recommendation. Rather than calculating realization in isolation, report worked realization (reflecting discounts), billed realization (reflecting pre-bill write-downs), and collected realization (post-bill write-offs) as a group.

Reporting this way will offer cross-lifecycle views while simultaneously providing insights about specific periods. Moreover, you can combine metrics to examine cash “leakage” and broader patterns more clearly and with less confusion. You will be able to contrast performance zones and improve diagnostics to resolve issues faster.

To add depth to your analysis, add inventory management metrics (e.g., billing speed, collection speed, DSO) to supplement insights about your realization with the hidden costs of stale inventory.

Generally speaking, avoid realization calculations that mask underlying issues, and obscure the reality of value achievement across the matter lifecycle. It creates confusion and misunderstanding.

Problem 2: Realization is your primary profit metric.

The next common error is the use of realization as your primary profit metric. The problem is that realization doesn’t measure profitability directly. It provides a one-dimensional profit view and overlooks many more direct profit measures like leverage and margin. The takeaway is that realization can’t stand alone when reporting profitability — although it can serve as a great wingman to answer profit questions.

Recommendation: When it comes to profitability, don’t throw realization out, but make it part of the larger profit metric group. Recognize its inherent limits balanced against its virtue. Recall realization’s definition I proposed above: value achievement. Improving your realization will increase profitability, but there may be other more impactful, structural things you should do to improve your firm’s profit position.

Problem 3: Mismatching time periods creating distorted results.

Occasionally firms will use a metric called simple realization. This calculation holds constant the period for the numerator, but compares it to standard value in the same period even if worked earlier, creating a timing mismatch.

For example, imagine for your fiscal quarter, you take all your relieved inventory comparing it to standard worked value in the period. This calculation compares apples with “apples and oranges” (some of the inventory has been worked in a prior quarter, and your comparative value may be higher or lower than the comparison group). Large inventory carry-over will inflate realization and vice versa. The distortion depends on your cash conversion cycle (e.g., billing and collection speed), the period when you are calculating realization, and your overall economic trend quarter-to-quarter.

Recommendation: Don’t calculate simple realization. But if you have to, calculate it over a long enough time horizon where the distortion is minimized (e.g., semi-annually or annually).

Summary

As law firms enter the profit era, realization remains a valuable statistic for measuring performance. But there are a few common errors that you should avoid or correct to better position the firm for success. It will help avoid confusion and reduce a false sense of achievement for the partners.

Be on the lookout for narrowly calculated metrics that obscure the underlying reality; use caution to extend realization single-handedly to inform important topics like profitability; and ensure you calculate realization with matching periods. Your performance will thank you for it!

[1] Note that the above definition does not speak directly to profitability. It is possible to maintain high realization but not be profitable. I like to say that realization is not a good proxy for profitability but that it serves as a good wingman supporting other direct profit metrics.

[2] Note this is not the same idea as reflecting a discount on a bill. Reinforcing concessions at the invoice is a worthy exercise to ensure client acknowledgement, alignment and appreciation of the overall service value. The trouble that arises frequently is that many firms through their accounting systems are unable to separate discounts from write-downs for proper analytics, clouding the source of the leakage problem.

Posted In