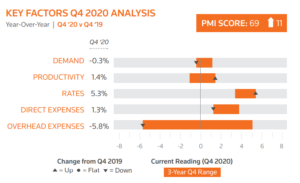

The Peer Monitor Index (PMI) just reported Q4 results from 2020, observing that the index hit its highest quarterly score in its history and further stating that “the legal industry finds itself … in its best health … in years.”

While I am not sure I would agree it is in its best health, the industry performance in 2020 was astounding. It is a testament to lawyer resilience[1] to the practice, the fiscally conservative nature of many firms (yes, there are exceptions), the fact that demand held up better than most recessions, and that the mix of lawyers supported an already strong pricing position.

The PMI was created slightly over a decade ago in the heart of the financial credit crisis. At that time, we were attempting to boil down to one number the change in law firms’ profitability strength. The current positive score may indeed represent resiliency and industry health. On the other hand, it may be a unique combination (the “perfect storm”) of profit change factors that may be hard to replicate in the year(s) to come – a false positive of sorts, due to the unique characteristics of a once-in-a-lifetime pandemic.

Let’s explore what drove those numbers and how they might operate in 2021 and beyond. The factors that make up the PMI include the following: demand, productivity, rates, direct expenses, and overhead. For each factor, I will assess its likely impact on future performance.

- Demand was resilient and possibly the most surprising law firm performance element in 2020, holding nearly flat. In prior recessions, law firms experienced demand contraction into the double digits. I think it is fair to expect that demand will do as well and possibly better than 2020. Deal work that contracted in spring 2020 rebounded in the second half, creating momentum into 2021. The uncertainty associated with this forecast inquires how the practice mix will change into 2021. Will there be material changes to deal flow activity? How will litigation evolve? And what will be the overall demand profile for firms?

Forecast for 2021: Favorable. Demand will be improve led by transactional work and perhaps regulatory. If our economy encounters a second pandemic wave requiring a different vaccine, all bets are off.

- As used in PMI, Productivity (a misnomer) measures average utilization by lawyer. It isn’t so much a productivity measure as a balance of headcount to demand. This measure saw an improvement of 1.4% in Q4, driven mainly by a significant cut in lawyer headcount during the year. Recent lateral reports indicate that lateral growth slowed as well in 2020. I would not expect this trend to continue to the same level in 2020. Even though we are still dipping our toes into 2022, hiring and lateral activity will likely pick up in 2021, reducing the positive impact of balance, absent a dramatic uptick in demand.

Forecast for 2021: Neutral to Unfavorable. Utilization will be supported by a gradual demand uptick but offset by competition for laterals and the hiring of associates.

- 2020 rate strength experienced pricing momentum carried forward from 2018-2019 and the maturity of the pricing function in many law firms. Matter leakage (write-downs primarily) partly offset worked rate strength resulting in a reduction in collected realization. But a more senior mix of lawyers additionally supported strong rate and pricing performance overall.

Forecast for 2021: Neutral. Rate strength will carry some momentum into 2020, but there will be headwinds from clients as price sensitivity increases.

- Direct Expenses. Direct expenses represent the investment in billable timekeepers. Like the discussion on productivity above, it will be difficult to believe that this factor will be better than 2020, as firms increase their hiring in laterals and associates.

Forecast for 2021: Neutral to Unfavorable. Hiring will rebound from 2020, even if slightly. That will create pressure on direct expenses compared to 2020.

- Overhead Expenses. This one is interesting. While law firms went beyond the call in cutting overhead expenses in 2020, there are two primary questions in play. The first question is whether the 2020 expense cuts can/should continue (i.e., can we get by with less marketing/BD investment). And second, where do firms stand on the journey to rein in real estate expenses? On the first question, the answer is partly yes. Firms learned how to get by with less investment. But the depth of those cuts is likely to be reduced in 2021. And on the second very fascinating question, it may take some time and strategic thinking, but 2020 taught us how ready we were to work remotely while reinforcing how important it is to be together at times. Workplace design most certainly will not be a one-size-fits-all approach, but real estate expenses most certainly will decline in the coming years.

Forecast for 2021: Favorable. Firms will begin spending again in 2021 but will be much smarter about the ROI. And the journey for smarter expenditures on real estate and remote working has just started but unquestionably to be reduced in the coming years.

Lastly, for 2021, consider other factors affecting profitability, even if not reflected directly in the index above.

One is financial operations/hygiene: timekeeping speed, billing speed, collection speed, and aged inventory. Firms made great strides in these areas in 2020, and I expect a resulting favorable trend in profitability for firms in 2021.

Next is client fee growth. A firm can report a positive score even if its overall health is at risk from heightened competition or other factors affecting fee growth. Essentially, PMI doesn’t measure top-line growth — a key measure of firm vitality. A law firm can only get so far through cost-cutting. Thus, firms must pursue innovative ways to connect with clients and serve them more fully, supporting the top line. Fee growth is the most challenging element for firms today (demand now is more widely dispersed to in-house teams, national/global competition, technology companies, and alternative providers). But these threats and client opportunities must be factored into your profitability strategy in 2021 and beyond.

That summarizes my forecast for industry 2021 law firm profitability. Here is to a prosperous and healthy 2021 for you and your firm!

[1] My friend Dr. Larry Richard, the legal psychologist, often makes the point that the typical lawyer personality profile ranks low on the personality trait for resiliency. That may be true and yet most lawyers are indeed committed to their practice, pride themselves (to their detriment at times) at being extraordinarily hard working. Moreover, while they are resistant to change, most actually embrace a crisis, as a testament to their willingness to face adversity as part of “who they are.” Does that mean that the ingredient to law firm change is a global pandemic? I hope not!

Posted In