Today’s blog is the last installment of a three-part series on Big Pricing Misses1. Pricing is one of your strongest drivers of profitability. Consequently, improvements here will result in meaningful implications for overall performance.

Over the past two weeks, I have presented the first two Big Pricing Misses I frequently observe: (1) the harmful effect of unnecessary discounts and (2) the compounded effect of rate stagnation.

Today I will discuss Big Miss #3: Wide Rate Dispersion and the importance of pricing uniformly. Finally, I will offer thoughts on rate trends into fiscal 2023.

Big Miss #3: Wide Rate Dispersion

It is common to observe law firms operating pricing schemes2 where similarly situated lawyers perform services for widely differing rates. It leads to significant firm pricing underperformance and can create client confusion.

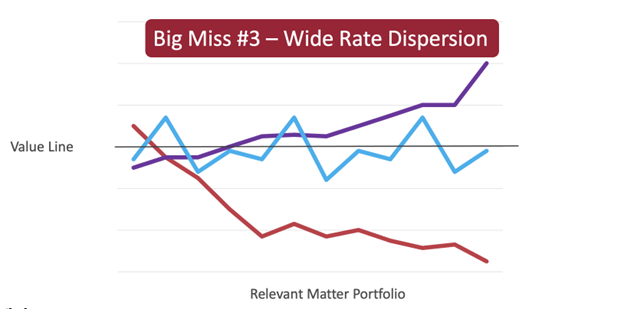

To illustrate the point, imagine a theoretical pricing curve where you graph all your timekeepers on the horizontal axis with their rate on the vertical. Then draw a horizontal line on the chart representing the fair market value (FMV) rate.

The chart visually answers two questions: (1) your pricing level relative to FMV and (2) your rate variance. Even if you price above FMV, there may be an opportunity to tighten your pricing range.

For illustration, I have drawn a chart with three different pricing scenarios below:

In the chart above, the purple line progresses from discount to premium for most of their timekeepers. The red line dives far below FMV with no consistency. And the blue line hugs FMV with varying degrees of success, occasionally realizing a premium but mostly discounting.

Note that all lines above exhibit high variance among the timekeepers, presenting opportunities to improve pricing through better uniformity.

To perform this exercise for your firm, follow the process below to test pricing uniformity.

- Create your firm’s chart like the above, sequencing similarly situated3 lawyers across the horizon against rate level on the vertical.

- Observe differences and the overall curve shape.

- Ask whether your curve embodies your intended strategy or if it looks random.

- Explore where the firm shares unified market value by service clusters.

- Group those clusters into uniform standard rates.

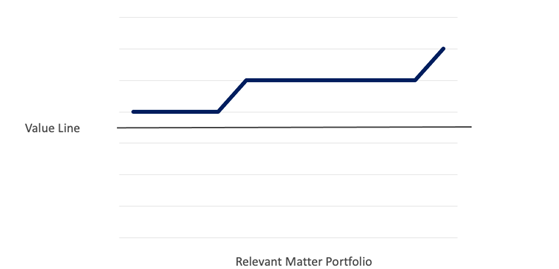

The chart below represents a visualization of a firm with greater pricing uniformity4:

Benefits of Uniform Pricing

The benefits of uniform pricing include:

- Firm Focus. The most significant benefit of uniform pricing is the firm-level focus on pricing execution. Firm-level pricing orients the question of rate level towards firm value, away from individual lawyers who may maintain rate quirks and unjustified exceptions. Individual rate setting leads to greater discounting — a natural human tendency.

- Objective Value Discovery. A uniform pricing strategy offers an objective approach to pricing with an emphasis on overall firm value, market positioning, and future aspiration. It invites you to review — top-down and bottom-up — your market performance. And through this process, firms uncover performance gaps. Some firms report circumstances where they view themselves as superior to the market but are collectively underpriced. A holistic, systematic firm-level approach would move you to remedy this situation sooner.

- Better Pricing Results. In the end, firms with uniform pricing approaches tend to outperform the market, gaining millions of dollars annually.

The model illustrated above represents a concept. But the dashboard below represents a real-life example of an analytical rate dashboard I recently created for strategic rate setting. It highlights rate dispersion, uniformity, and outliers segmented by practice, class year, service line, and other factors. And it illustrates how you can apply this analysis in tangible form.

Summary of Three Big Pricing Misses

To recap, over the past three weeks I have described the three Big Pricing Misses you should avoid:

- Unnecessary discounting and its magnified impact on profitability;

- Rate stagnation and its cumulative compounded effect on growth and profitability; and

- Wide rate dispersion, which creates discounting pressures and client perception risks.

Avoiding them increases your odds of higher profits and improves your market pricing position. As always, the LawVision Team and I are happy to help you think through the execution of these strategies.

Special Note on Fiscal 2023 Rate Trends

I have recently been asked about my views on fiscal 2023 rate strategies. Next year may be a critical year for pricing for the following reasons:

- Demand uncertainty for legal services is higher for 2023 compared to recent years;

- Rising talent costs have created a higher hurdle rate for realizing net real rate increases; and

- Clients’ pricing sensitivity may be higher due to economic volatility.

In sum, firms may face more acute margin pressure in 2023 compared to the past five years, which will compound your errors.

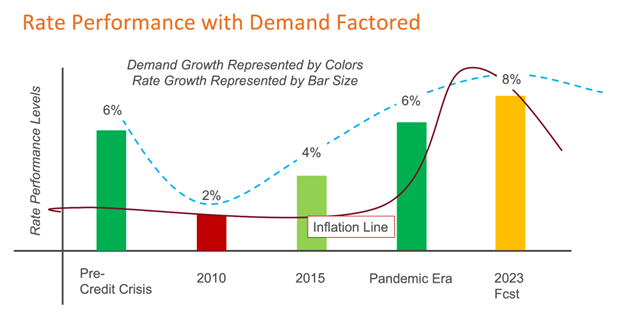

In response, I created a rate trends chart (below) that ties the recent past into fiscal 2023.

The chart above illustrates the current rate cycle that reached a low point just after the credit crisis but then accelerated in 2015 through the pandemic and has continued through this year. If demand slows and real rate increases decline (due to inflated talent costs and margin compression), an aggressive approach to fiscal 2023 pricing may be your best bet.

More specifically, we anticipate a wide variance in rate increases in fiscal 2023, but if the trend line continues, the industry may realize 8% nominal rate increases.5

So, in the theme of Halloween: Beware and be thoughtful about your approach ahead.

1 The three big misses are: Unnecessary Discounting, Flat Rates, and Wide Rate Dispersion.

2 Intentionally or through random rate policies.

3 Similarly situated means lawyers performing similar services with similar experience and expertise. They would be presented to the market as peers. This won’t be easy or perfect, but it begins your journey to thinking firm first and individual lawyer second relative to pricing.

4 Note that even if the curve shifted down and operated more closely to the Value Line, this curve is superior to at least the blue and red lines above.

5 In real terms, those increases may be smaller compared to recent years due to inflated costs.

Posted In