Great attention is paid to rate and pricing strategy for many law firms but, paradoxically, managing cash flow well is frequently overlooked. Imagine a scenario where a law firm executes pricing strategy terrifically only to lose profit and value on the backend of the matter lifecycle.

That scenario is what the recent BigHand Legal Cash Flow survey just reported. More concerning, during the past pandemic years, these inefficiencies have been masked against strong service demand and artificially reduced expenses, creating hidden risks.

2022 BigHand Legal Cash Flow Report

Shortly after announcing their acquisition of Iridium Technology, BigHand released the 2022 Legal Cash Flow Report[1], which includes critical findings about cash flow and firm profitability based on 800 responses from law firm leaders and value/finance chiefs. Highlights include:

- Profit leakage (discounts, write-downs, and write-offs) has increased through the pandemic, but many firms overlook this because of strong demand.

- Significant causes of profit leakage include missing or late time entries, lack of matter budgeting, and matter staffing errors.

- Client intake and engagement models are a major source of underpriced or improperly scoped matters for one quarter or more of firms responding.

- During the pandemic, firms were aided in cash management because of expense reductions while aged WIP and AR increased. However, as expenses rise again (e.g., salary wars, BD expenses), downward pressure on profitability will mount.

- Many law firms do not provide their lawyers with sufficient education to understand cash risks associated with aged inventory, and cash management processes need improvement.

Strategic Cash Management Ideas

Below are actions to take to shore up your cash management risks and raise your profitability:

- Surface the Issue. One of the challenges with cash flow management is competition between the Urgent and the Managing inventory is important but not urgent. The daily grind associated with time tracking and reviewing WIP/AR may not be that interesting to many practitioners, so it gets pushed to the bottom of the to-do list. Furthermore, since many lawyers think in terms of billable hours and not profits, they may not directly connect the two.

Action: Connect cash management to profit concepts and set specific improvement goals. Make the topic urgent through goal setting and by conducting routine checkpoints. Calculate lost opportunities from poor cash management and set out how the firm intends to raise the bar. In most cases, improvements are made simply by surfacing the issue and elevating its visibility.

- Create Early Warning Systems. Inventory management is like the increasingly untidy house – minor issues gradually pile up to create messes! Use metrics that help you spot potential matter risks sooner and formalize actions (e.g., playbooks) to address them appropriately.

Action: Develop risk models based on attributes such as client, partner, and service grades. Use risk scores to segment and contextualize your inventory, which will enable you to create signals that lead to specific actions. Use this process as a guidance system to keep your firm on track to avoid big cash flow mistakes.

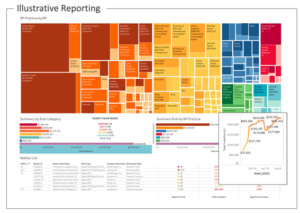

- Use Modern Reporting Systems. Today’s reporting systems can easily visualize trends and automate risk reporting, enabling routine inspection and issue spotting. For example, applications like Iridium (now part of BigHand), and DIY tools like Tableau and Power BI can offer real-time views about your cash flows, identifying problems like realization declines, WIP spikes, slow releases, and aging inventory.

Action: Exploit current software systems and get meaningful action-triggered reports into lawyers’ hands. Develop routine checkpoints at operational and executive levels within the firm. Provide feedback and assistance to partners having difficulties or dealing with challenging clients. Below is an example of a risk report:

(c) 2022 LawVision Strategy LLC

(c) 2022 LawVision Strategy LLC

- Create Accountability Loops. All the above is meaningless if there is no accountability for your outcomes. Therefore, connecting these measures to feedback loops and the compensation system is critical.

Action: Connect the steps above to regular feedback loops for your lawyers. Set specific quarterly and annual targets. Provide support for those needing help and ensure that people are aware and accountable for cash management success.

Summary

The pandemic years offered law firms a perfect storm of extraordinary profitability. Now, cash management practices must be improved in the face of salary wars, rising expenses, and demand volatility. As Warren Buffett said, “[o]nly when the tide goes out do you discover who’s been swimming naked.” It is time to get our suits on.