Posted In: Profitability, Uncategorized

Your Profitability Change Matrix

Changing Legal

Last week I announced my role as a co-founding member in the Changing Legal (CL) think tank (link). CL seeks to reduce friction in legal, thereby enabling faster change. The group will advance creative pricing models, increase the adoption of industry standards and drive innovation. In short, CL focuses on execution, specifically at the cross-roads where law firms and their clients meet.

CL relates directly to my work at LawVision, where I help law firms improve financial performance focusing on profitability, pricing, and data/analytics. But moving the performance needle for firms requires buy-in on the programs I help introduce. It is a specialized form of change management.

How do we make change happen faster? One way is by removing barriers to progress. Identifying barriers more quickly will help you accelerate productive change.

Lippitt Change Model

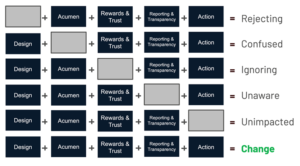

Below is Mary Lippitt’s change model I frequently reference when discussing the people side of new initiatives.

This long-standing model consists of columns and rows, highlighting factors Mary identified as critical to change: vision, skills, incentives, resources, and an action plan. Your plan must address all elements on the planning matrix to achieve your desired goal.

The matrix is a planning tool but also serves as a handy diagnostic. You can work backward, matching organizational sentiment to correlating planning blocks, identifying those elements that require bolstering. If you hear frustration, take a closer look at your resourcing plan, for example.

Profitability Change Matrix

This model is highly adaptable as well. For example, I created a law firm profitability change matrix illustrated below and will discuss how this model may help you in your profit projects.

To increase your chances of a successful profit deployment, consider the following elements:

Design. Design is a Goldilocks problem. You want to balance the fairness quotient in the model without over-engineering it, which is a common mistake. Design begins with thinking about profit metric context and use. Profit metrics applied at the client are different than those at the matter or by the timekeeper. Do people trust and believe in your design? Don’t expect your partners to go deep into modeling. It will stall progress, and it goes beyond most of their expertise. Do invite input on utilization, matter management, client service, and pricing that inform profit metric design. Be inclusive but recognize the different levels of expertise and roles and responsibilities of profit design.

Acumen. Acumen is a cultural keystone for profitability. Do your partners understand how profit operates with other performance measures? The myth is that there is only one profit metric. In reality, metrics work together. Trust and confidence must preside over your profit metrics. And it is developed through education and honest discussion about profit metric purpose and application.

Rewards. Compensation is the hot button of profitability. Direct line-of-site profit metrics are used infrequently in most compensation systems today (although subjective profit assessment is common). Thus, it is typical that partners resist profit metrics for fear of a fundamental change in their reward system. Key takeaways here are that: (1) changes made to compensation based on profitability should come in the later stages of profit deployment, usually after a few years of use, and (2) profit metrics should be informative and instructive rather than punitive devices. The secret of profitability is that it informs service delivery, matter, and client management. It is a building block of innovation.

Reporting and Transparency. Reporting is the gateway to trust. It becomes a difficult profit journey if your firm has a history of keeping performance metrics hidden. That is not to say that performance data should be completely open. But to achieve firm acceptance and receive the greatest returns on your metrics, policy changes over data sharing are typically required.

Action. Action drives change; change drives impact. For metrics to have meaning, action must follow. Data scientists describe this as data action rates. Profit can inform how you manage matters, structure fees, plan client strategies, and a host of other things. So, you should monitor how profit guides behavioral changes in the practice. The great irony is that while profit metric design often takes center stage in profit discussions, contemplating appropriate uses and corresponding actions is perhaps even more critical.

In sum, profitability is a strategically important endeavor for most firms today. But this is not as much a numbers game as a cultural shift. As you think about your comprehensive profit framework, be sure to consider the matrix above to increase your chance for acceptance, adoption, trust, and productive application.

No Comments